11 Simple Ways to Save Money

Anyone nowadays how difficult it can be to save money. What follows in this post are some frugal living tips that can help you spend wisely on things that genuinely matter and avoid being trapped by inflation.

First Things First

- Take care of your fixed expenses.

- Invest consistently where you feel comfortable (the amount depends on your budget)

- Save into your emergency fund for a rainy day (at least 6 months’ worth)

Every so often, look over your fixed expenses and call your lenders, banks, providers, etc. and see if there are ways to reduce this or bundle payments so that you can save.

Once your emergency fund has been built up, the amounts you were putting away there can be re-allocated wherever you need them. (For instance, to pay off student loans)

Of course, investments and emergency funds aren’t required in life, but they are highly recommended.

Next, Develop a The Right Mindset

Once your fixed expenses are out of the way, the rest is up to you to control. You control where you spend your money, and you should use that power to make sure you do everything possible to spend it wisely. In order to abide by frugal living, you need to get into that mindset.

1. Only Buy What You Need

Put recreational spending on hold. It’s non-essential and can wait.

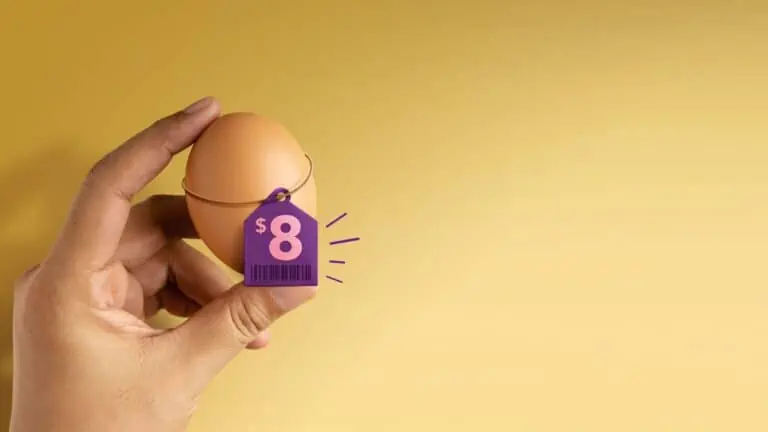

2. Avoid Lifestyle Inflation

Lifestyle inflation is the worst. Ignore your neighbors and whatever they’re doing. Focus instead on your own needs, expenses, and financial situation.

Get The Most Bang For Your Buck

Here’s how to stretch your dollar as far as it can go.

3. Look For The Best Deals

Compare rates. If you can shop online, use ebates or other cashback apps to help you save. Bargain shop whenever possible – sales, outlet stores, etc. Remember, you don’t need to pay full price to get high-quality items.

4. Consider Bulk Spending

This can help you save in the long run, especially if you have families. Costco and Sam’s Club memberships work well here. Paying for memberships upfront annually often can reduce long-term costs (e.g., gym memberships).

5. Don’t Sign Up For Subscription Services

Most sign-ups are cheap or free up front, and then we forget about them and forget to cancel before the cost increases. Review services you actually need and use and stick to those. Avoid anything that doesn’t serve you.

Cancel any that you aren’t using!

5. Return Items You Don’t Use Or Like

How many people go shopping, especially online shopping, get their stuff, and maybe it doesn’t fit right, or you’re unsure? Now, how many forget to return those items sometimes? Make it a point that if you purchase something and it’s not working out, go and try to get your money back. Those few dollars here and there can add up.

6. Purchase Better Quality Items

Sometimes spending a little more upfront can save you in the long run. For instance, better quality clothes last longer, which means you have to replace them less often, saving on future costs.

7. Try your hand at DIY

Try fixing things yourself! Youtube is a great resource, as is a simple Google search. It takes a little extra time out of your day; however, the savings can be huge.

Save on Day-to-Day Spending

For the random day-to-day stuff, it’s easy to accept what is. However, there are ways to save.

8. Save on Utilities

Avoid high usage during expensive, peak hours of the day. You can also consider investing in a Nest thermostat where you can control settings from your phone.

9. Discount Grocery Stores

You don’t have to use them for everything, but certain items here can save you a lot.

10. Don’t Eat Out

Try to cook at home versus eating out and attempt to reduce food waste. Meal prepping is a great way to cook in bulk, and save money and time.

11. For Fun

Going on adventures around your new home can be super exciting; however, many of them can cost you. Don’t brush off the free things to do in your new hometown. For instance:

- Visit parks, and museums, go to the beach (if you live near one), go hiking, play outdoor sports, and go for picnics

If you’re unsure about how to afford a vacation, then consider staycations over big international trips – especially in the beginning when you’re still trying to figure out your spending and saving ability. When you go on international trips, create a travel budget, and save up for them separately.

When you plan an evening out on the town or go out to eat, look for and attend happy hours, and look for discount events so that you don’t have to pay full price for those drinks.

What Happens When You Can’t Save?

At some point, cutting expenses will reach a plateau. There’s only so much you can do, especially during times of inflation. Plus, there’s the whole “needing to have fun” aspect of life as well. While saving and investing is important, life is short and needs to be lived.

If you plateau, look for ways to increase your income, start charging for things you already do, negotiate a higher salary when you’re able to, or look for more lucrative opportunities.

To Summarize

These frugal living tips and money-saving moves can help you save in a big way, especially when finances are tight during inflation. Even though everything is more expensive, you can apply these frugal tips at any time.

As you can see, many of these examples aren’t just about saving money but also about spending it in the best way possible. Try some of these tips and see if they help you!